Whistler

Sales activity in Whistler increased by 21% compared to April, with a total of 41* transactions in May. While this figure is a 22% decrease year-over-year, there is a noticeable uptick in market momentum.

Townhomes stood out as the most active segment, with sales more than doubling compared to May 2024, and rising 60% month-over-month. There were 86 new listings added to the market-just shy of March’s high and the second most so far this year. Total inventory remained steady at 338 listings, aligning closely with inventory levels from the same time last year. In terms of pricing, the median sales price for chalets declined both month over-month and year over year, while townhome and condominium prices saw gains. Days on the market increased significantly across all property types compared to last May, with chalets averaging 143 days, townhomes 73 days, and condominiums 31days to sell. The sales-to-active listings ratio shows a balanced market overall, with the townhome segment leaning slightly in favour of sellers.

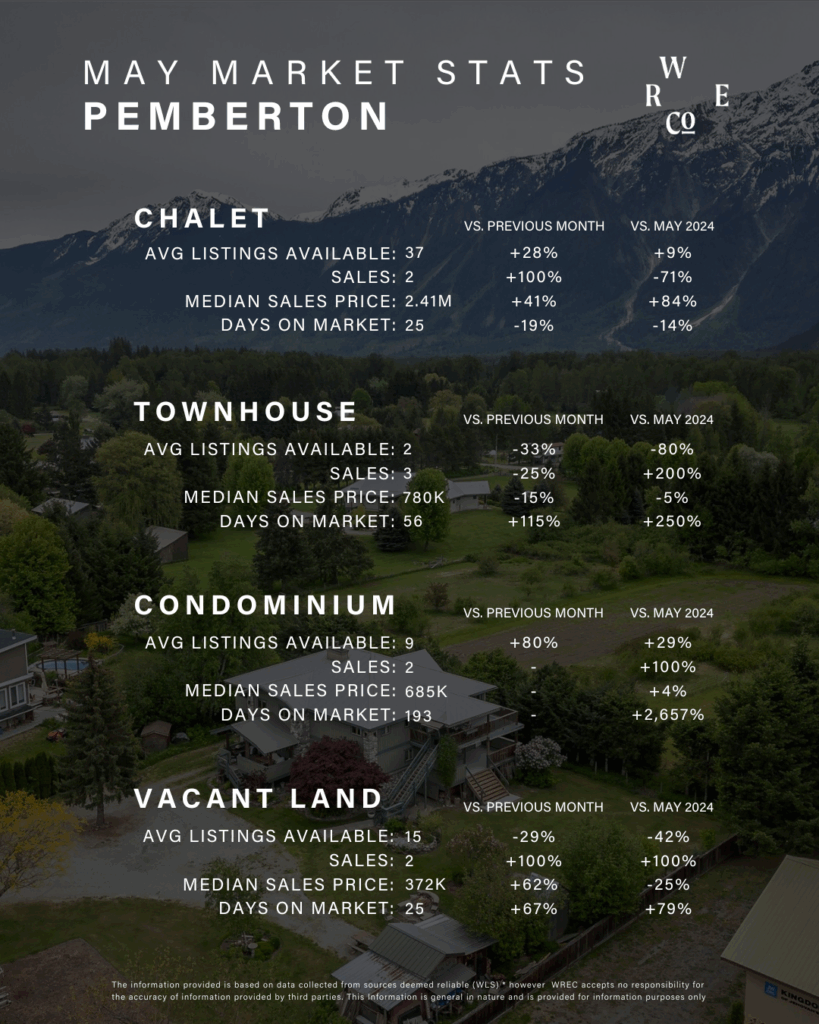

Pemberton

In Pemberton, there were 10• sales in May-the highest monthly total since October. Overall inventory rose by 10% from April, reaching 67 active listings or 52 excluding vacant land: the highest level in eight months. May also brought 21new listings to market, the most in a single month since May 2024. Notably, the Pemberton market recorded its first sale over the $2 million mark this year, possibly signaling renewed buyer confidence in the luxury segment of the market. Median days on the market for single-family homes sold decreased to 25 days, while condominiums and townhomes saw longer selling times compared to both last month and May of last year.

Overall, the Pemberton market stays active and balanced.

Economic Context

On the macroeconomic front, the Bank of Canada held its benchmark interest rate steady for the second consecutive time. This could signal a period of stability, encouraging buyers and sellers to make real estate decisions with greater confidence. While inflation remains within the BoC’s target range, some core metrics have crept upward. At the same time, Canada’s unemployment rate has risen slightly, and U.S. tariffs add economic pressure. These factors could prompt the Bank to consider further rate cuts to support economic stability.

Finally, it’s worth reminding clients that Vancouver housing market headlines-such as slowing sales and rising inventory-don’t necessarily reflect the unique dynamics of the Whistler and Pemberton markets. Well-priced properties are still selling quickly, often attracting multiple offers. Buyers need to stay alert and be prepared to act fast.

For further information and details, please contact me at [email protected]